A major shortage of memory chips is driving global prices to record heights, leading industry experts to forecast that hardware like laptops and smartphones will become significantly more expensive throughout 2026. This trend is largely due to the massive expansion of artificial intelligence infrastructure, which is monopolizing current manufacturing capabilities.

Samsung Electronics, the top global memory producer, recently indicated that these supply constraints will likely force price hikes across the entire tech sector. Despite these challenges for consumers, the company reported a massive surge in quarterly profits, exceeding 20 trillion won. Both Samsung and SK Hynix have signaled their intent to increase server-grade memory costs by as much as 60–70% in the early months of 2026.

“In 2026, there’s going to be issues around semiconductor supplies, and it’s going to affect everyone,” Wonjin Lee, Samsung’s president and head of global marketing, told Bloomberg at CES 2026. “We’re going to be at a point where we have to actually consider repricing our products.”

The current crisis is fueled by manufacturers prioritizing high-bandwidth memory (HBM) for AI data centers over standard consumer chips. Because HBM requires three times the production capacity of regular DRAM, supply for personal devices has been severely restricted. Companies like Micron have even pulled out of the consumer market to focus on enterprise clients, while others report their 2026 capacity is already completely booked.

By the end of 2025, contract prices for standard DRAM had already risen by nearly 60%, and experts predict further double-digit growth. Leading PC brands like Dell and HP are warning of potential 15–30% price increases for their hardware later this year. Similarly, smartphone costs are expected to rise, potentially causing a slight dip in global sales as higher price tags impact consumer demand.

“Demand is significantly outpacing supply, mainly driven by AI and infrastructure needs,” said Jeff Clarke, Dell’s COO, in December. “This is the worst shortage I have ever witnessed”.

Analysts believe this imbalance will last well beyond 2026. Because tech giants like Amazon and Google are securing the majority of available silicon for their cloud networks, supply growth for the general public remains stagnant. Real relief is not anticipated until at least 2027, when new manufacturing plants are expected to finally begin operations.

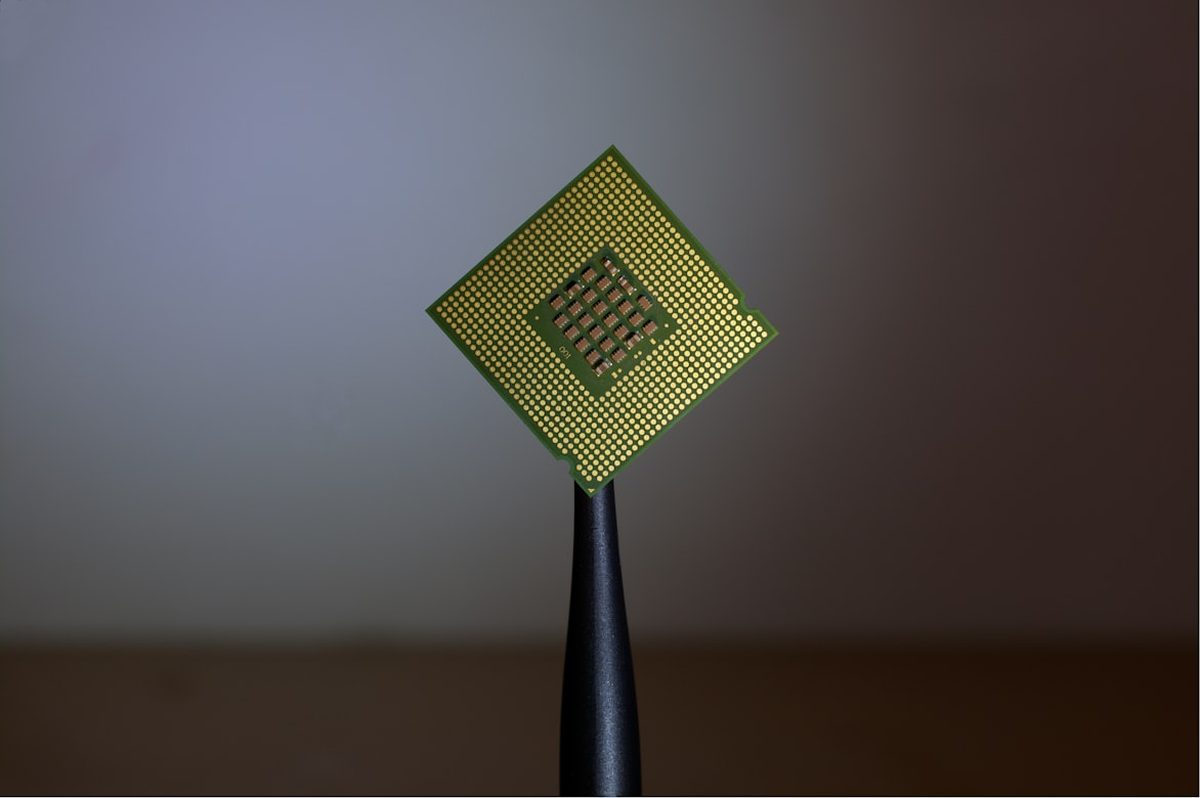

Featured image credit